Congressman John Kline (R) sent out a letter spinning his support of the estate tax legislation that protects only the $UPER RICH. Since Kline’s been in office his zealous safeguarding of the wealthy is well known. The question to ask is when is Rep. John Kline going to take care of the average Minnesotan who elected him into office?

Congressman John Kline (R) sent out a letter spinning his support of the estate tax legislation that protects only the $UPER RICH. Since Kline’s been in office his zealous safeguarding of the wealthy is well known. The question to ask is when is Rep. John Kline going to take care of the average Minnesotan who elected him into office?In his letter Kline says, “Knowing of your opposition to the estate tax, I thought you would be interested to learn of recent activity on this issue in the House ofRepresentatives….In June, we passed a bi-partisan compromise which will provide significant relief from this destroyer of family owned farms and businesses.”

Kline's statements more closely represent urban legends and myths than facts….‘Destroyer of Family owned farms and businesses’? Yeah right, name one farm in Minnesota in the last year affected by this? Once again $uper DeKline comes to the aid of the $uper Rich! Consider the facts:

With the current exemption level of $1.5 million, a CBO analysis found, only 300 farm estates in 2000 would have owed any tax at all - and of those, just a paltry 27 would have a tax bill in excess of their liquid assets. And, most of them would have the cash on hand to pay the tax owed. So this bill would have helped barely a handful of rich farmers but will help very wealthy families that have nothing to do with farming. Ask John Kline to name one farm lost to the estate tax since he’s been in office.

In fact, less than 3 percent of deceased adults in 2002 had estates subject to the tax, according to the nonpartisan Urban-Brookings Tax Policy Center and figures from the IRS. So again, Kline protects the top 2-3% richest families in America!

In fact, less than 3 percent of deceased adults in 2002 had estates subject to the tax, according to the nonpartisan Urban-Brookings Tax Policy Center and figures from the IRS. So again, Kline protects the top 2-3% richest families in America!Even one of the leading advocates for repeal of estate taxes, the American Farm Bureau Federation, said it could not cite a single example of a farm lost because of estate taxes.

The argument about a double tax is also ‘double talk’. While it is true that some portion of a taxable estate might be made up of cash that was taxed before, when it was earned as income, most of all estates are made up of stocks, bonds, real estate or other holdings that have appreciated greatly in value over the lifetime of the person who owned them. The owner didn't pay taxes on that profit during his or her lifetime because they weren't sold and the profits weren't turned into cash, or "realized."

Furthermore, heirs who inherit such appreciated assets won't have to pay tax on that unrealized profit either. The estate tax is the only tax that applies to such unrealized capital gains.

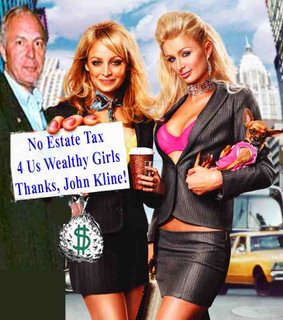

This bill was never meant to protect farmers or farms or families of working Americans, If it had been, Kline probably would not have supported it. This bill supports only the riches of the very rich and that’s why it was dubbed the Paris Hilton bill. Only the top 1-2 % of wealthy families in America. Kline's voting records shows he protects big oil, big corporations and $uper wealthy people but not the average Minnesotan. His support of this legislation is just more proof of that.

This bill was never meant to protect farmers or farms or families of working Americans, If it had been, Kline probably would not have supported it. This bill supports only the riches of the very rich and that’s why it was dubbed the Paris Hilton bill. Only the top 1-2 % of wealthy families in America. Kline's voting records shows he protects big oil, big corporations and $uper wealthy people but not the average Minnesotan. His support of this legislation is just more proof of that.Over the years, the discussion of the estate tax hasn't exactly been noted for its intellectual rigor. But Kline’s vote on this issue and now his continued exaggeration of it’s affect on farms and families borders on malfeasants and lack of ethics. Either he’s stupid or he’s brought and paid for by special interests for the misinformation he continues to peddle. Personally I believe it’s a combination of both!

While Kline may characterize this as a death tax or saving farms and families, the facts speak for themselves. The estate tax is not a tax on death. It’s a tax on the transfer of large amounts of money. More than ninety-nine percent of Americans who die pass their estate on to their heirs completely tax-free — in fact, they get a valuable tax break on capital gains. Zero estate tax is charged on assets left to a spouse or to charity.

Super Kline once again saves the wealth of the $uper rich from being taxed for the common good of American.

No comments:

Post a Comment