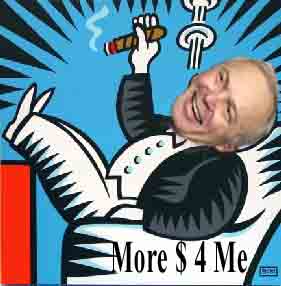

John Kline and his buddies in Congress try and hide their pay raises:

John Kline and his buddies in Congress try and hide their pay raises:"As part of its normal course of business, Congress has buried a pay raise for itself in a larger spending measure….And why would Kline and the members of Congress try and bury this? Because incredibly while Kline gives himself a payraise, he opposes even a symbolic non-binding resolution to raise minimum wage for America's working poor!

But if a raise is necessary, then members of Congress should have the courage to argue for it on its merits rather than try to hide it in a huge spending measure. Congress should vote up or down on a pay raise."

According to the Children's Defense Fund, over a third of the workers whose families would benefit from an increase are their families' sole breadwinners. As for the notion that only teens would benefit from the increase, almost 80 percent of those who would benefit are adults.As the DFLers goes on to report: The most frequently uttered criticism of minimum wage increases is that they are "bad for the economy." However, the Economic Policy Institute reports that there is no evidence minimum wage increases have a negative effect on the economy. In fact, in states that raised their minimum wages, there was no effect on economic growth.

It turns out about the only think Kennedy and Kline know about minimum wage earners is that they are very poor. And whom do we have to thank for that?

2 comments:

While I really don't want to see Congress raise its own pay, if your objective is to help the working poor, an expansion of the Earned Income Tax Credit would be a much more effective and equitable way of doing so than raising the minimum wage.

I would agree to a point...as two comments on your blog indicate:

A one-time payment in April is nothing compared to a consistent annual increase in salary, even if that money is exactly the same amount. The opportunity cost of the EITC is pretty great. Furthermore, while I don't advocate repealing the EITC, raising the minimum wage would actually raise federal revenue, at least in payroll taxes, while expanding the EITC would lower it. I believe a combination of both is acceptable.

and then, JML said...

Reading dday's comment helped me remember one more advantage to wage increases over EITC increases: pride. Reading into the views held by recipients (or potential recipients) of the EITC, one is left with the distinct impression that recipients consider the EITC a handout. A higher wage brings a more content, more productive worker and member of society. The EITC is a brilliant concept but cannot quickly reverse the view deeply held by so many Americans that an hour worked should mean an hour paid.

Post a Comment